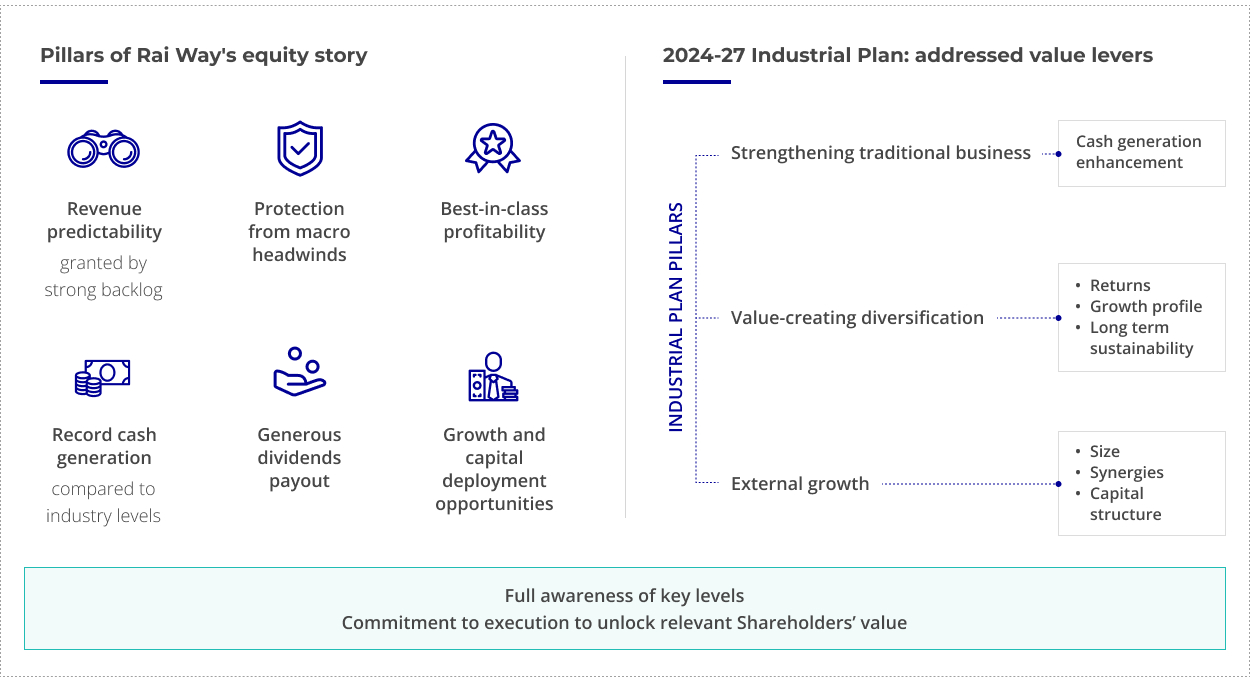

Equity story

The soundness of a stable and profitable business, combined with opportunities for diversification in the digital infrastructure of tomorrow

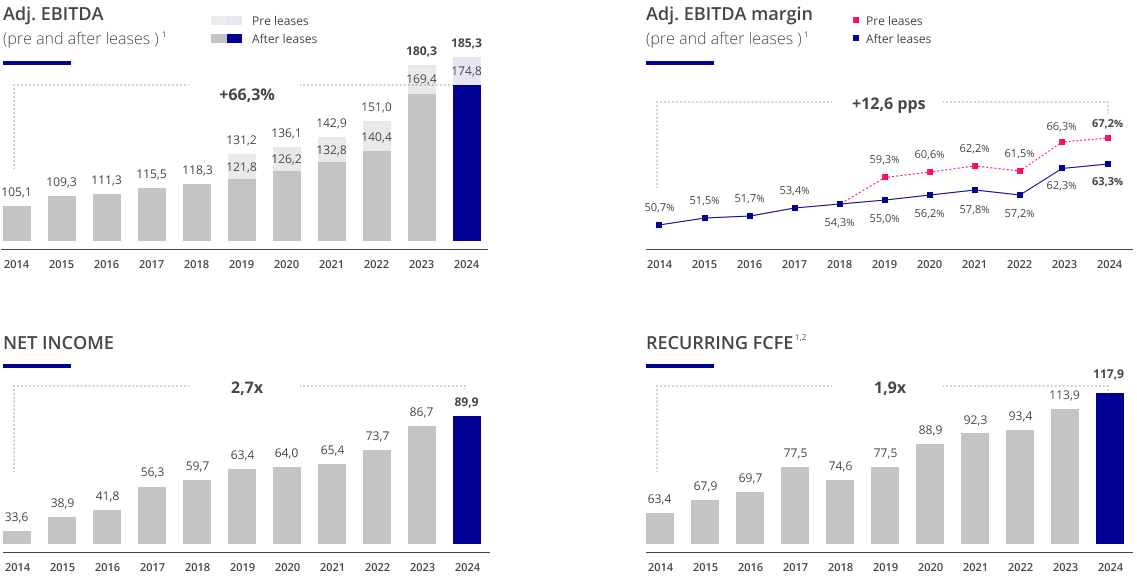

Since its listing in 2014, Rai Way has experienced uninterrupted growth in all its main economic and financial metrics.

1 Impact of leasing estimated as a sum of the depreciation of rights of use (excluding dismantling) and financial charges on leasing contracts.

2 Recurring FCFE = Adj. EBITDA – Leases – Net Financial Charges – P&L Taxes – Recurring Maintenance Capex.

The strengths of our business model

Entry barriers, visibility and resilience

- Best broadcast infrastructure portfolio in Italy, uniquely able to provide 99% population coverage on the DTT platform, with high barriers to entry guaranteed by non-replicable assets

- Prospective visibility ensured by long-term contracts with clients with high standing and reliability

- Resilience and defensive characteristics compared to cyclical and volatile economic factors, as also demonstrated during the COVID-19 pandemic crisis period, related to the type and mission critical nature of services provide

Opportunities for growth and diversification

Growth opportunities, both organic and by external lines, arising mainly from:

- Technological upgrade and extension of coverage required by traditional TV & Radio broadcast platforms (e.g. DVB-T2, DAB), related to the peculiarity of ownership of the active component as well as the passive infrastructure under Rai Way

- Extension of tower hosting services for wireless telecommunication networks in digital divide areas (e.g., 5G, FWA)

- Better enhancement of existing assets, such as the proprietary fiber-optic transmission network and land portfolio spread across the country

- Introduction of content distribution services on broadband platforms

- Expansion, synergistic with corporate assets and expertise, of managed digital infrastructure through the creation of a Data Center network

- Digital evolution of the operating model and maintenance models

Cash generation and shareholder remuneration

- High operational efficiency, with best-in-class profitability that will further benefit from strong operational leverage and digital transformation

- Cash generation, with cash conversion* stably above 80%

- Policy to distribute 100% of income generated to shareholders**.

Sustainability

- Sustainability embedded within corporate strategy and operations, with challenging ESG targets (e.g., Carbon Neutrality by 2025, 100% electricity from renewable sources by 2020), aligned with the highest international principles and standards

- Sustainability model that combines shareholder value creation with environmental protection, respect for people and diversity, community development, and ethical and responsible business conduct

* (adjusted ebitda after leases – maintenance capex) / adjusted ebitda after leases

** dividend policy of the Business Plan 2024-2027

Rai Way's strategy, in addition to defining the path of industrial evolution, aims to address the key levers to bring out the full value of the Company, while preserving its distinctive features.